Description

What our Stock Market lesson plan includes

Lesson Objectives and Overview: Stock Market is a great lesson for 5th and 6th grade students. Your students will learn all about the stock exchange and related terms. They have likely heard of the stock market, but they may not fully understand it. Students will learn about buying, investing, selling, and trading. And they will even have the chance to simulate the stock exchange and purchase and trade stock.

Classroom Procedure

Every lesson plan provides you with a classroom procedure page that outlines a step-by-step guide to follow. You do not have to follow the guide exactly. The guide helps you organize the lesson and details when to hand out worksheets. It also lists information in the yellow box that you might find useful. You will find the lesson objectives, state standards, and number of class sessions the lesson should take to complete in this area. In addition, it describes the supplies you will need as well as what and how you need to prepare beforehand.

Options for Lesson

You can check out the “Options for Lesson” section of the classroom procedure page for additional suggestions for ideas and activities to incorporate into the lesson. Students may work alone or in groups for the activity. You could also increase or decrease the length of time for the activity. Have students create an imaginary company and give other students a set amount of money to invest in the imaginary companies. Then discuss how students decided on the investments. Invite a stock broker or another financial expert to speak with the class about the stock market, investing, etc. Assign each student a company of which they can research the stock value from the company’s founding up to the present day.

Teacher Notes

The teacher notes page provides an extra paragraph of information to help guide the lesson and remind you what to focus on. While students may have heard about the stock market, they may not really understand what it involves. This lesson is meant to provide a foundational understanding. You might also benefit from teaching this lesson in conjunction with others about money or the economy. The blank lines on this page are available for you to write out thoughts and ideas you have as you prepare the lesson.

STOCK MARKET LESSON PLAN CONTENT PAGES

Introduction to the Stock Market

The Stock Market lesson plan contains four pages of content. The word stock simply refers to the supply of a product or maybe a service. And the market is usually a public place where people can buy, sell, or trade those products or services. However, in a financial market, the stock refers to the supply of money that a company has raised. The money comes from people who gave the company money in the hopes that the company will make a profit. In return, the people who gave the money will earn more money.

Stock market, then, is the business of buying and selling stock. It is not a place like a grocery store or a food market. Wall Street is the name of a street in New York City’s financial district, and sometimes we say “Wall Street” to refer to the United States stock market. The financial district is the place where many people (or computers) buy and sell stock for themselves and other people.

The first stock market began on May 17, 1792, when 24 stockbrokers (people who buy and sell stock) and merchants signed the Buttonwood Agreement. This agreement had two provisions. First, the brokers were only to deal with each when buying or selling stock. And second, commissions (the money brokers made on each sale) were to be 0.25%. The agreement was signed underneath a buttonwood tree.

Later, the agreement led to the formation of the New York Stock and Exchange Board. This is now the New York Stock Exchange (NYSE), which is a company on Wall Street. It is also the world’s largest stock exchange. It provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. There are other stock exchanges throughout the world as well, such as the London Stock Exchange (LSE) and another American exchange called the NASDAQ (National Association of Securities Dealers Automated Quotations) Stock Market.

Using the stock exchanges brokers, people and businesses can invest their money in public companies throughout the world. The public companies often want to grow their business, build more factories, or develop new products. So they turn to the selling of stocks to raise money for the company.

How Stocks Work

The next page outlines how the stock market functions. A company could borrow money from a bank to grow their business, but they would have to pay the money back to the bank. However, instead of borrowing money, a company can issue stock and raise money without going into debt. The people who buy the stock give money to the company to help the business grow.

In some way, you can think of it as opening a lemonade stand. After you open, you realize you don’t have enough money for all the supplies. You ask your parents for some money to help pay for lemons, cups, signage and other supplies. They give you the money, and you start selling. Once you begin making a profit, you pay them back and give them some of your profits. However, if you lose money, your parents will lose their money too. It is a risk they took to help you build your lemonade business.

Only business corporations can issue stock. A business owned by one person (sole-proprietorship) or a few people (partnership) cannot. A corporation has a special legal status and does not depend on the people who run it. And it has legal rights and responsibilities to the people who buy the company’s stock.

Shareholders and Stockholders

People who buy stock in a company own part of the company. Each part they own is called a share. For example, let’s go back to the lemonade stand. If you sold 100 shares of stock in your company at $1.00 per share, a person who purchased one share would own 1% of the company. A person who had 25 shares would own 25% of the company. The people who own the stock are called stockholders or shareholders.

The shareholders usually have voting rights in a company too. They could vote in people for the board of directors, for instance. The board will run the company and make major decisions for the company’s success. Stockholders usually have one vote for each share of stock they own. That means that the more stock a person owns, the greater influence they may have on the company. Quarterly or yearly reports are also sent to stockholders to inform them how the company is doing.

Every stockholder wants the company to grow and earn a profit. If the company earns money, the stockholders share the profits after the expenses are paid. Usually, when people invest money in companies by purchasing stock, they will earn more than they would if they left the money in the bank or made other investments.

For example, if the lemonade stand made a profit of $100, the people who purchased shares of the stock would double their money and earn a 100% profit. Banks and other investments usually yield much less. Of course, not all stocks earn such a high rate of return. But over time, investing in and buying shares of stock in a company usually leads to a greater profit.

On the other hand, if a company does poorly, goes out of business, and loses money, a stockholder can lose the money they invested in the company. The prices of stock for a company, though, will usually rise and fall over time. For example, a share of stock in a company today might cost $23, but tomorrow it could be worth $25 and the next day drop to $22. The rise and fall of stock prices drive people to “play” the stock market for a living.

Playing the Stock Market

There are people who play the stock market by buying and selling stock at the right time to earn money. For example, if the price of a stock goes down, a broker may purchase the stock at the lower price. They hold it for a while until the value of the stock rises or goes up and then sell it. If they can do this, they earn a profit simply by buying and selling stock at the right time.

For example, your lemonade stand stock may be worth $1 a share in the beginning but go up to $1.25 per share. The people who originally invested can now sell their shares for 25 cents profit per share to someone who is willing to buy the stock. The value of the stock could go down, however, and shareholders could lose money.

Students will learn that stock prices fluctuate daily and weekly. People will often hold onto a stock for a much longer period of time. The price of the share will change often, but over a long period of time, the value of stocks often rises. In summary, if a company does well, the value of shares rises. If a company struggles, the value of shares will go down.

Investors and brokers are often the people who follow the stock market very closely and invest another person’s or company’s money. They follow the overall rise and fall of the stock market and watch closely for companies that may increase in value and those that may decrease in value. At the end of each day, the market determines the overall value of stock shares that companies, brokers, and investors bought or sold, or traded. The stock market value is then reported as going “up” or “down.”

There are stock markets throughout the world, and investors will carefully watch what happens to the value of stocks in other countries too. Sometimes this helps them make choices as to whether they should buy or sell shares of stock throughout the day.

Bears and Bulls

There are two groups of investors—bears and bulls. A bear is an investor who believes the stock market will go down and will be cautious when buying stock. A bull is an investor who believes the stock market will go up and put more money into buying shares of stock. Investors can also be bearish or bullish about a single kind of stock. The term bear market describes a time when stock prices are falling. Naturally, then, a bull market is a period of rising stock prices. Bear markets are usually bad; bull markets are good.

Without stocks (the shares of value in a company), many businesses would not have the money to grow and develop their products or services. The idea of a stock market has been around for a long time. In fact, people purchased stocks to finance the Pilgrim’s voyage to America. They hoped the travelers would find something valuable in the New World, ensuring the investors made a profit.

For example, imagine that friends you know want to search for gold reportedly buried in the side of a mountain. Your friends might need money to purchase equipment and tools. You give them the money hoping the gold will be found. If it is, they have agreed to give you a certain percentage of the profit.

STOCK MARKET LESSON PLAN WORKSHEETS

The Stock Market lesson plan includes three worksheets: an activity worksheet, a practice worksheet, and a homework assignment. Each one will reinforce students’ comprehension of lesson material in different ways and help them demonstrate when they learned. Use the guidelines on the classroom procedure page to determine when to distribute each worksheet to the class.

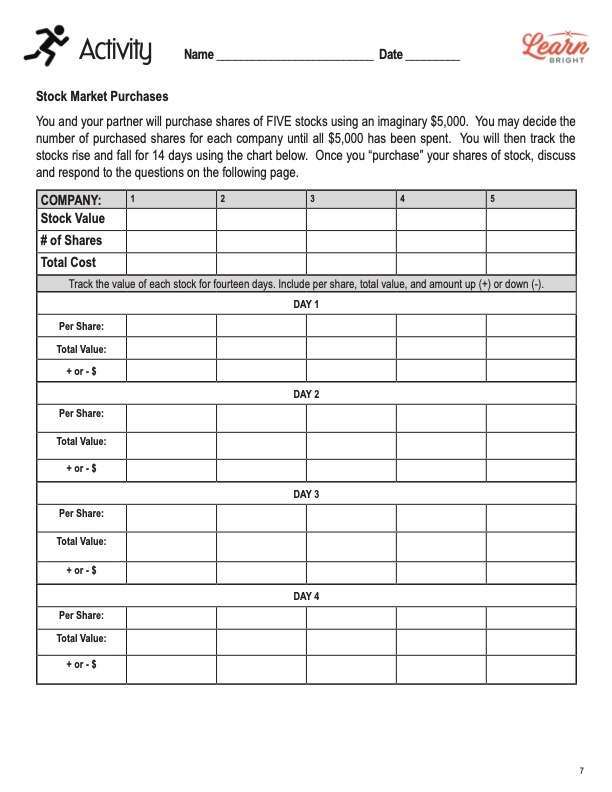

PURCHASE SHARES ACTIVITY WORKSHEET

After dividing into pairs, students will purchase shares of five different stocks. They will have an imaginary $5000 to allocate among the stocks. They will track the rising and falling prices of the stocks over a period of time. The lesson states two weeks. However, you could provide real companies for the students to monitor and adjust the amount of time they will track the prices.

At the beginning of the activity, students will answer a set of questions. After the two weeks pass, they will answer another set of questions based on their experience.

DEFINITION MATCH PRACTICE WORKSHEET

The practice worksheet lists 15 statements. Students will match the definition to the correct term. Afterward, they will answer five other questions, most of which are based on the lesson material.

STOCK MARKET HOMEWORK ASSIGNMENT

For the homework assignment, students must first fill in the blanks to 10 questions using the words in the word bank. Afterward, there is another set of statements. Students will determine whether the statement is true or false and mark it appropriately.

Worksheet Answer Keys

There are answer keys for both the practice and homework worksheets at the end of the lesson plan document. Correct answers are in red to make it easy for you to compare them to students’ work. If you choose to administer the lesson pages to your students via PDF, you will need to save a new file that omits these pages. Otherwise, you can simply print out the applicable pages and keep these as reference for yourself when grading assignments.