Description

What our Money Handling lesson plan includes

Lesson Objectives and Overview: Money Handling introduces students to the concept and practical application of handling money. Challenge students to consider the happiest time of their life and determine the cost of that happiness as a discussion point to underscore the value of relationships, experiences and time over money, which is a tool that when managed well can bring more people together to experience more happiness. At the end of the lesson, students will be able to create a small budget, practice wise spending, and identify and define terminology related to money and handling money. This lesson is for students in 4th grade, 5th grade, and 6th grade.

Classroom Procedure

Every lesson plan provides you with a classroom procedure page that outlines a step-by-step guide to follow. You do not have to follow the guide exactly. The guide helps you organize the lesson and details when to hand out worksheets. It also lists information in the blue box that you might find useful. You will find the lesson objectives, state standards, and number of class sessions the lesson should take to complete in this area. In addition, it describes the supplies you will need as well as what and how you need to prepare beforehand.

Options for Lesson

Included with this lesson is an “Options for Lesson” section that lists a number of suggestions for activities to add to the lesson or substitutions for the ones already in the lesson. One optional adjustment to this lesson is to use the Practice page as a homework assignment. You can also have your students use manipulatives to practice handling money, giving change, and paying for items. You could also have a banker or similar person speak to your class about money.

Teacher Notes

The teacher notes page includes a paragraph with additional guidelines and things to think about as you begin to plan your lesson. This page also includes lines that you can use to add your own notes as you’re preparing for this lesson.

MONEY HANDLING LESSON PLAN CONTENT PAGES

Money Handling

The Money Handling lesson plan includes three content pages. It’s not always easy to handle your money well! It’s often easier to spend money (also sometimes called capital, cash, or currency) than it is to earn money. However, you can learn to handle money responsibly. If you do that, it will be easier for you to buy the things you want and need in the future.

Before we used money, people would trade to get the things they needed. Today, it would be like trading some of your video games for a skateboard. You didn’t give or receive money but both of the items have value. Value is the importance, worth, or the usefulness of something. You might not see your old video games as having much value anymore if you’ve already played them, but the person you traded them to thinks they’re valuable enough to trade for a skateboard. Both of you are happy with the trade, because you both got something you found valuable.

Today, trading is much less common. Instead, we use money. The concept of value also comes into play with money! For example, would you buy a $10 bottle of water when there’s a free water fountain nearby? Probably not. However, if you were stranded in the desert with no other access to water, you would pay the $10. Context matters! If you were stranded in the desert but knew there was a store a mile away that sold water bottles for $1, you might choose to walk to the store, even though it takes longer and takes more effort. By doing so, you can save $9.

When handling money, it’s also important to consider the role that advertisements, emotions, and other people play. If you see a good advertisement for a new game, you might get excited and spend money you had saved on that game. In this example, advertising and your emotions affected how you managed your money. You should always think about your purchases before making them.

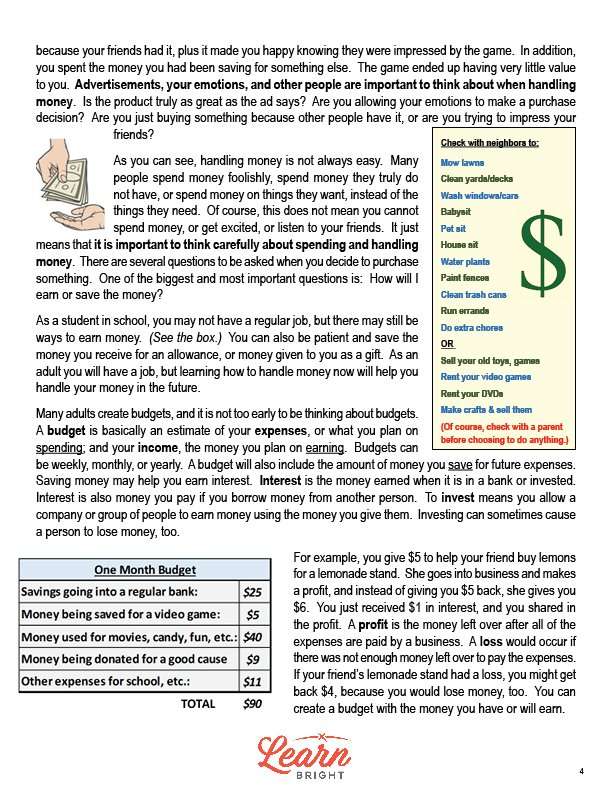

Many people find it quite difficult to manage their money responsibly. They might spend money on things they want but don’t need or spend money they don’t have. Remember that responsible money management does not mean that you can never buy something you want! You should just make sure you’re considering your purchase’s impact on your overall finances.

A good place to start is to ask yourself: How will I earn or save money? If you’re a student, you might not have a normal job, but you can still find ways to earn some money, like mowing lawns, babysitting, or watering plants. If you receive an allowance or money as gifts for holidays, you can choose to save that money instead of spending it.

It’s also never too early to learn how to budget. Budgets are essentially an estimate of your expenses, or what you plan on spending, and your income, or the money you plan on earning. People create weekly, monthly, or even annual budgets. Budgets also include any money you’re saving for future purchases. When you save money, you can earn interest. Interest is the money you earn when you keep your money in a bank or invest it. You also pay interest on any money you borrow from another person or bank.

You can sometimes lose money when investing, too. For example, you might give a friend $5 for a lemonade stand. If she makes a profit, she’ll repay your $5 plus interest and some of her profit! However, if the lemonade stand is not profitable, you might only get back $4 from your original investment. This is called a loss.

We can also imagine putting together a budget. Say you have $40 and receive an additional $50 as a gift. You have a total of $90. What could you do with that money? One option is to put it all in the bank. However, you could also budget it! For example, you might put $25 in the bank as savings; set aside $5 for video games; $40 for movies, candy, and other fun things; $9 for charity; and $11 for school expenses. All $90 is accounted for!

Even if you don’t have $90, you can start thinking about how to manage your money for now and in the future. You should decide what has value to you. When you spend money, think about the potential influence of advertising, your emotions, and pressure from the people around you. And always remember that money is not what will make you happy! Happiness comes from how you live your life everyday.

MONEY HANDLING LESSON PLAN WORKSHEETS

The Money Handling lesson plan includes two worksheets: an activity worksheet and a homework assignment. You can refer to the guide on the classroom procedure page to determine when to hand out each worksheet.

BUDGETING ACTIVITY WORKSHEET

For the activity worksheet, students will look at the included price list and imagine that they have $100 to spend in a month. They will choose the items they will purchase throughout the month, adding up their spending as they go. Finally, they will answer some questions about the activity, including identifying what the easiest and most difficult parts of completing their budgets were.

MONEY HANDLING HOMEWORK ASSIGNMENT

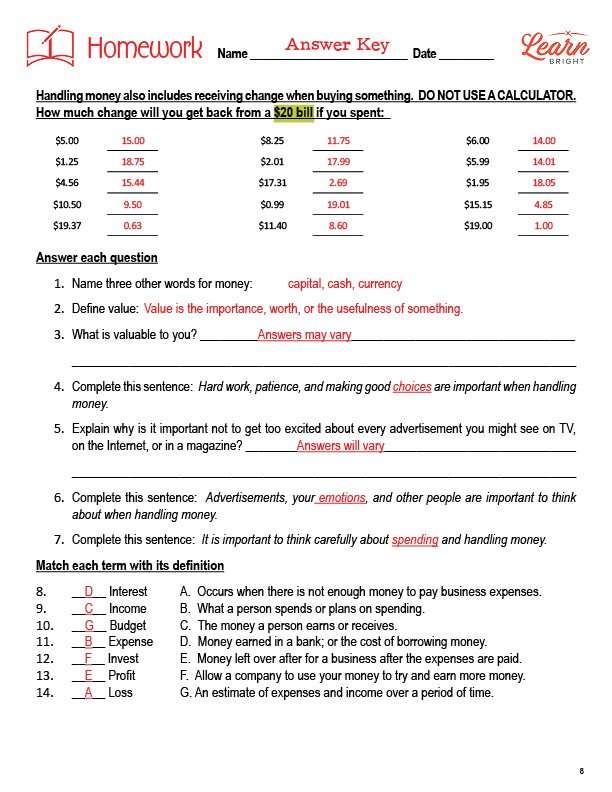

The homework assignment asks students to complete three exercises. First, students will determine how much change they would get back from a $20 bill if they spent different amounts of money without using a calculator. Next, they will answer seven questions about the lesson material. Finally, they will match terms with their definitions.

Worksheet Answer Keys

This lesson plan includes an answer key for the homework assignment. If you choose to administer the lesson pages to your students via PDF, you will need to save a new file that omits these pages. Otherwise, you can simply print out the applicable pages and keep these as reference for yourself when grading assignments.